Today we will walk through the weighted average cost of capital calculation (step-by-step).

Our process includes three simple steps:

- Step 1: Calculate the cost of equity using the capital asset pricing model (CAPM)

- Step 2: Calculate the cost of debt

- Step 3: Use these inputs to calculate a company’s weighted average cost of capital

To simplify each step in the calculation, we’ve developed a CAPM Calculator, Cost of Debt Calculator, and WACC Calculator.

After calculating the WACC, we’ll also cover a few key details, including:

- The actual WACC formula,

- What the WACC is, what it is used for, and

- How to calculate the WACC in Excel.

Let's dive right in to calculating the WACC...

Step-by-step guide to calculating the WACC

To calculate the weighted average cost of capital, the costs of debt and equity must be weighted proportionately based on the different types of capital used by the Company.

The first part of the calculation, which requires its own calculator altogether, is the cost of equity.

The standard model to estimate the cost of equity is the Capital Asset Pricing Model (CAPM).

Step 1: The Capital Asset Pricing Model (CAPM) Calculator

There is a general consensus that investors only invest in stocks if they can expect to receive a premium in excess of the risk-free rate.

Because of this, the CAPM model attempts to estimate the cost a company incurs to finance its operations with equity.

The CAPM model requires relatively few inputs: The risk-free rate, the stock’s beta, and the equity risk premium (also known as, the expected market return).

You can use the 10-Year Treasury Yield as the risk-free rate and the beta can be found on our stock valuation page for each company we cover, for example Apple's beta is 1.13:

The equity risk premium is more difficult to find, and can vary by country, and calculation.

As of this post, the equity risk premium for securities in the United States was 5.75%, China was 6.65%, France and the United Kingdom was 6.35%, Spain was 8.60%, and Japan was 6.80%.

You can find updated equity risk premiums here as well.

Now that you have the key inputs, our Capital Assets Pricing Model (CAPM) calculator does the hard work for you below:

There are other models that analysts use to calculate the cost of equity, but the CAPM model is used most frequently.

Now that you have the cost of equity, it’s time for a much easier step:

Calculating the cost of debt.

Step 2: The Cost of Debt Calculator and Formula

Calculating a company’s cost of debt is simple.

First, find the Company’s interest rate. If you don’t know the interest rate, you can calculate it by dividing the Company’s interest payments during the year by its total debt.

Next, you’ll need the Company’s tax rate, which can be found within its financial statements. If you don’t know the tax rate, go with 21% (it’s the corporate tax rate in the United States).

Finally, plug those numbers into the Cost of Debt Calculator below to find the Company’s cost of debt:

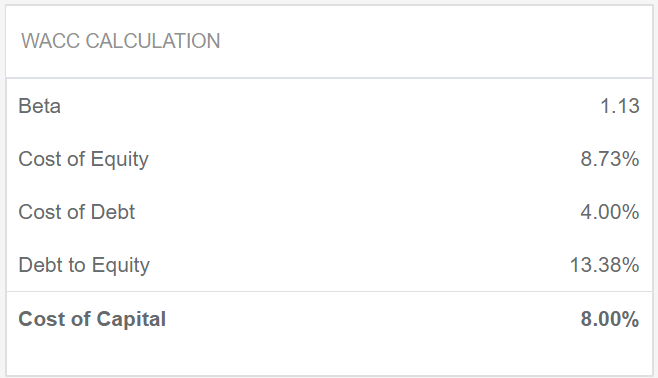

Step 3: The WACC Calculator

Once you have the cost of equity and the cost of debt, the rest of the calculation is pure math.

You’ll need the current value of the Company’s equity and debt to complete the WACC calculation using the calculator below:

You’ve now calculated a company’s weighted average cost of capital. For more details over the formula, how it’s used, or how to calculate the WACC in Excel, keep reading.

If you’re more interested in analyzing the WACC of any U.S. stock, and using it in a valuation model, you can search for a stock below:

Value Any Stock FREE!

Hours of stock valuation analysis in 10 seconds or less!

The WACC Formula

At its most basic form, the WACC formula is:

WACC = (E/V x Re) + ((D/V x Rd) x (1 – T))

Where:

E = Value of the company's equity

D = Value of the company's debt

V = Total value of capital (equity plus debt)

E/V = Percentage of capital that is equity

D/V = Percentage of capital that is debt

Re = Cost of equity (required rate of return)

Rd = Cost of debt (yield to maturity on existing debt)

T = Tax rate

You’ll notice that our calculator includes a field for the tax rate, which can be confusing. Why would this be necessary in the WACC calculation?

When a company carries outstanding debt, they receive the tax-shield benefit of interest expense. In contrast, the cost of equity does not provide any tax benefits.

Because of this, the tax rate is included in the WACC to account for the benefit the Company receives from the tax break.

What is weighted average cost of capital and who uses it?

A company can finance its assets and operations through debt, equity, or a mix of both. The WACC measures the cost to obtain capital from each of these sources and calculates the total cost of a company’s capital.

The WACC includes all sources of capital, including: bonds, long-term debt, common stock and preferred stock. The WACC formula looks at the pro-rata cost of debt and equity, in order to get a complete picture of a company’s capital structure.

A company’s WACC is the rate of return required for a business to maintain operations. If a company’s return falls below their WACC, they won’t have enough cash to make payments on the capital required to operate.

A company’s WACC is the appropriate rate to discount future cash flows to firm (FCFF). The FCFF model is considered an enterprise valuation model, because it includes both a company’s debt and equity in the value of a company.

That is why it is important to consider both the cost of debt, and the cost of equity in the discount rate.

If fact, we use the WACC as the discount rate in our stock valuation software to determine the fair value of each stock we analyze on the DiscoverCI platform.

How to calculate WACC in Excel

Microsoft Excel is a helpful tool you can use to calculate the WACC of a company.

First, set up a breakout of the Company's capital structure:

Next, calculate the cost of the Company's equity. This can be done by using the CAPM (Capital Asset Pricing Model) or Dividend Capitalization Model (if the company pays out a dividend).

In this example we'll use the CAPM:

The third step of calculating the WACC in excel is to find the Company's cost of debt using their borrowing rate and effective tax rate. Since interest is deductible for income taxes, the cost of debt is typically shown as an after-tax percentage.

You now have the capital structure, cost of equity and cost of debt laid out in front of you. The final step is to calculate the Company's WACC using the formula below:

+Excel+Formula.JPG)

And just like that, we've calculated a WACC of 11.74%. Well done!

What’s Next?

If you're calculating the WACC of a U.S. publicly traded company, you can skip all of these steps and let our stock valuation software calculate the WACC for you:

Get the WACC used in our Valuation Models

Or

Use one of our other stock analysis or stock research tools:

- Head over to our stock analysis page and search for a stock to start your analysis

- Quickly calculate financial metrics using our collection of financial calculators

- Use our fundamental stock screener to filter and screen for awesome companies

- Ready for another blog post? Check out our deep dive into finding undervalued stocks to buy in 2019