Tools For Faster, Better Stock Valuation

DiscoverCI’s valuation models, historical data, and quick input forms enable you to simplify the process of valuing a stock.

DiscoverCI’s valuation models, historical data, and quick input forms enable you to simplify the process of valuing a stock.

We were too. So we bundled up the Excel Workbooks, Data, and Dashboards to create the DiscoverCI Valuation Tool. Never spend hours searching for data, updating models, or investing without a valuation again.

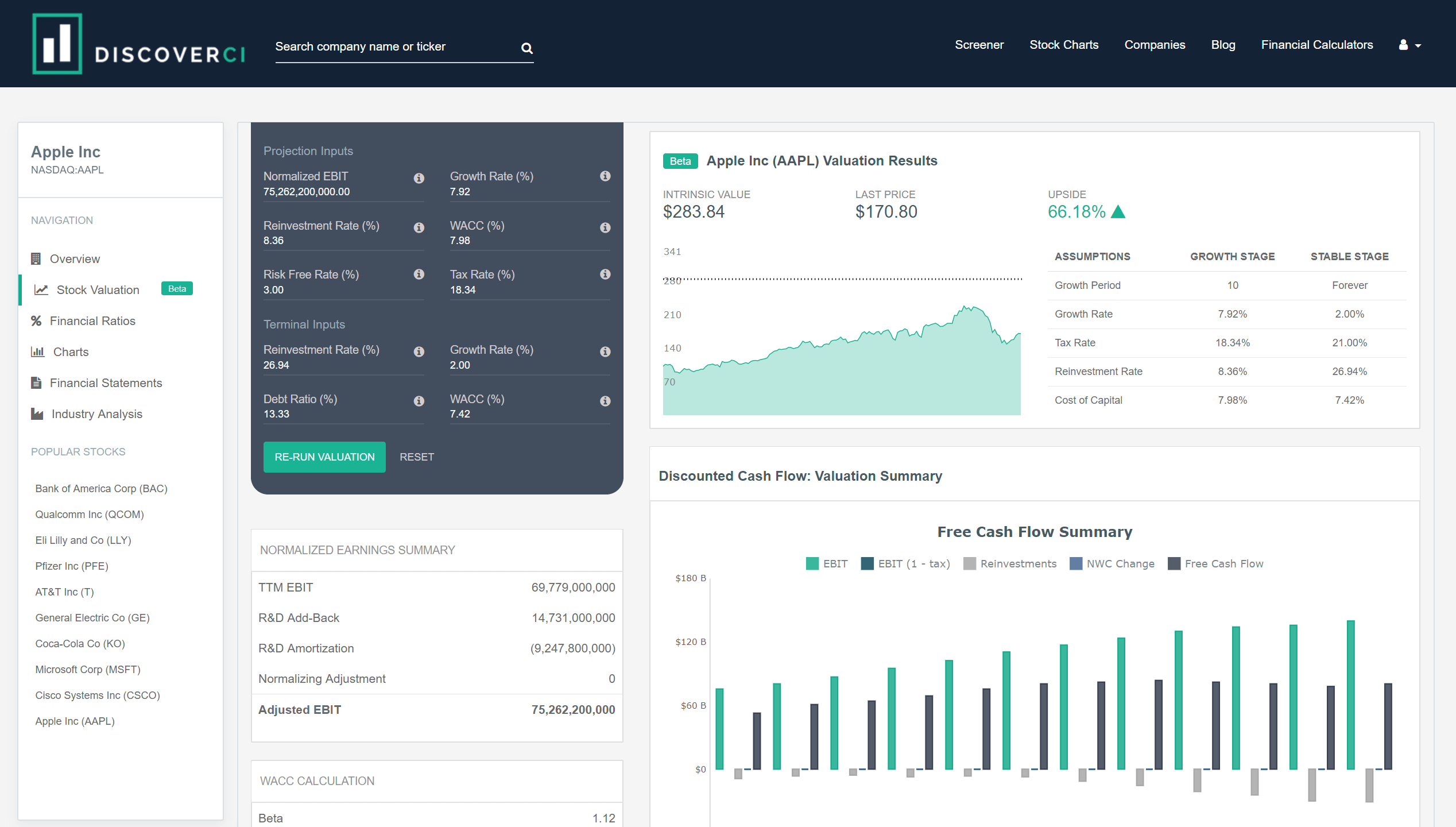

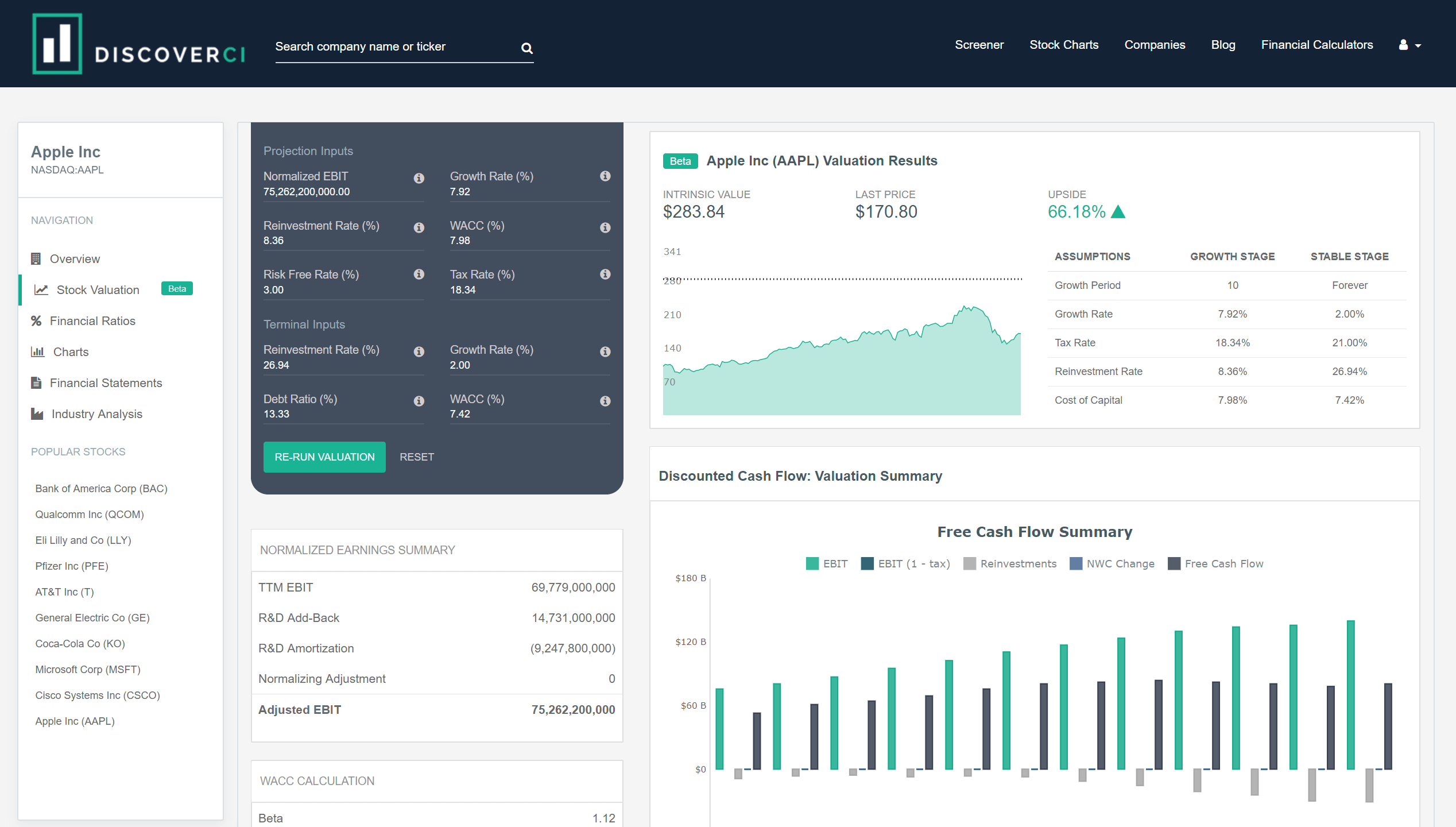

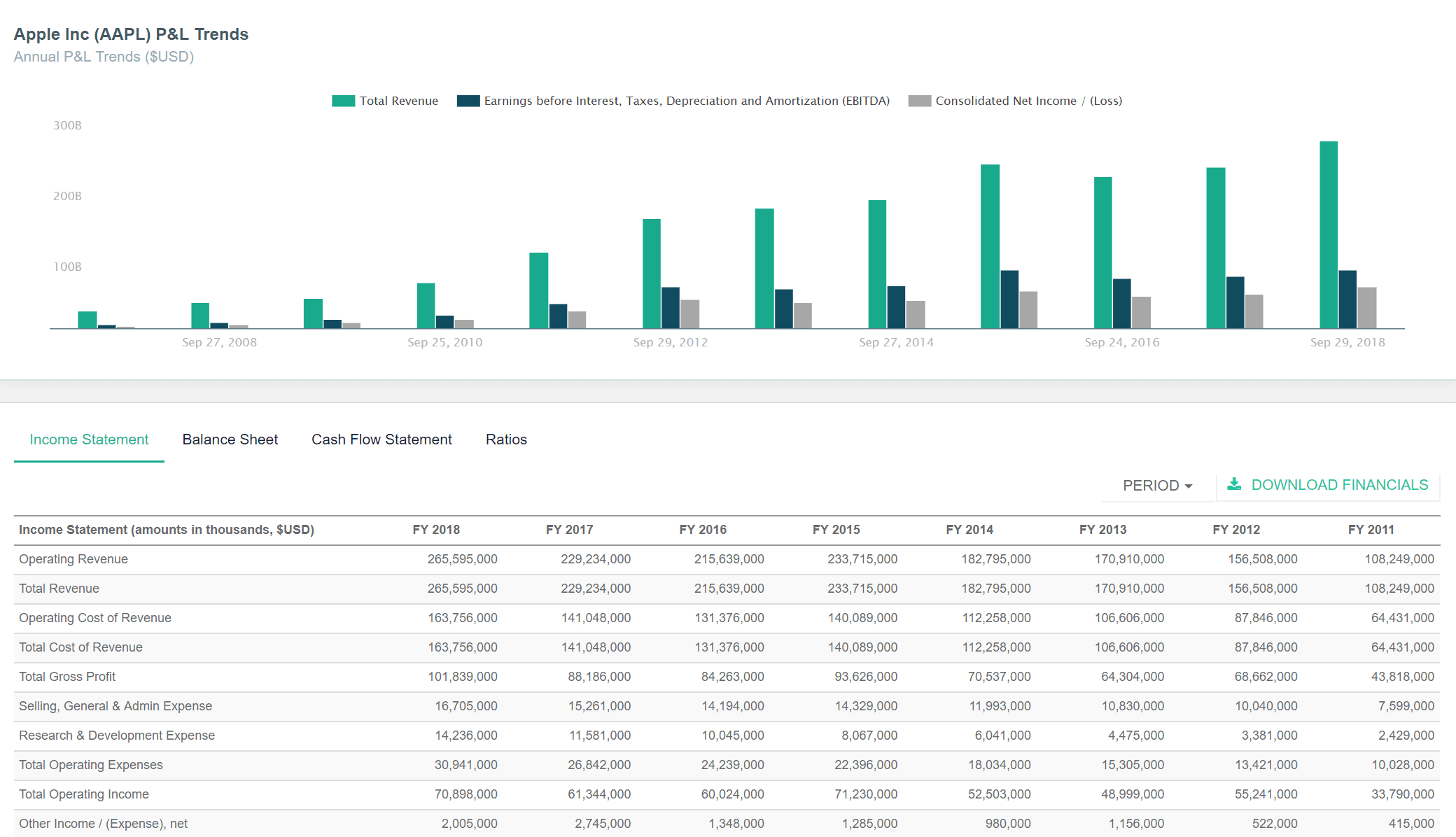

A valuation model is only as good as it’s inputs. As the saying goes… “garbage in, garbage out.” Our models use standardized financial statement data from company SEC filings. We calculate trailing twelve month figures, so our models continuously update on a quarterly basis.

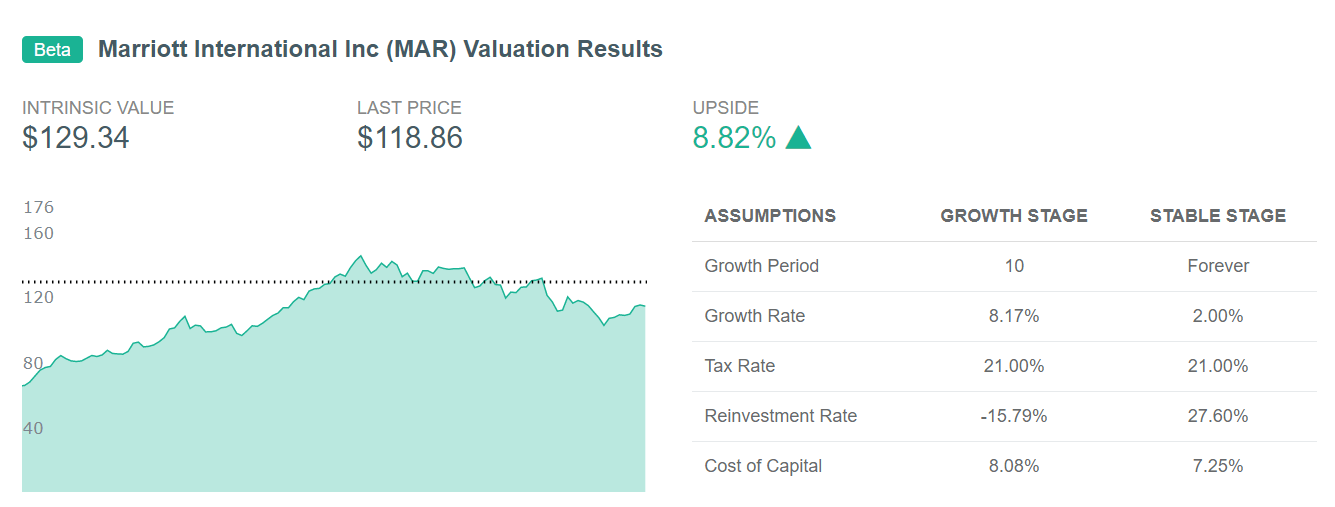

Eliminate the risk of building a model that fits your desired outcome. Our algorithm analyzes a company’s historical financial statements, analyst projections, and current trends to develop inputs that feed into the model that are free from bias.

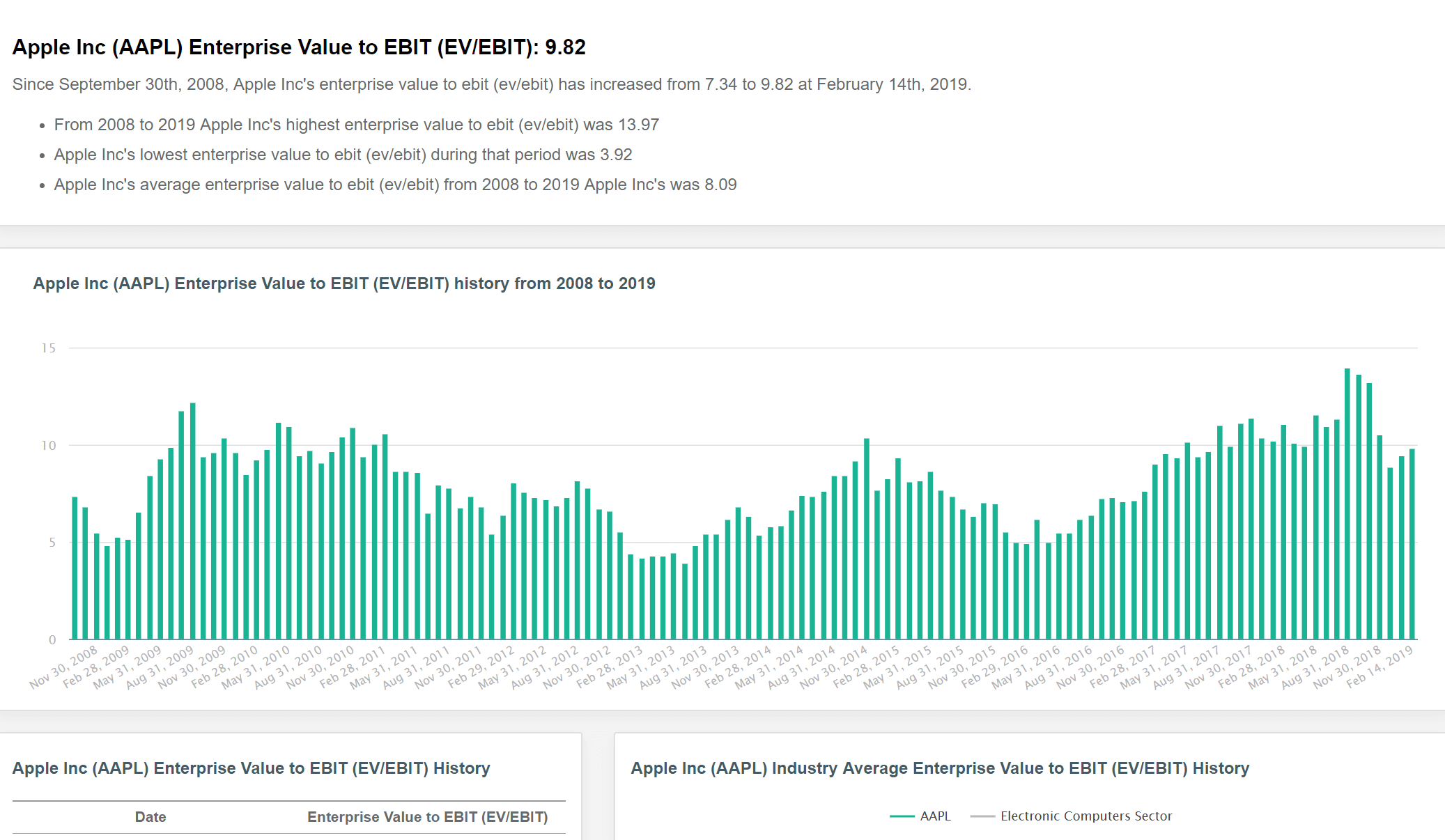

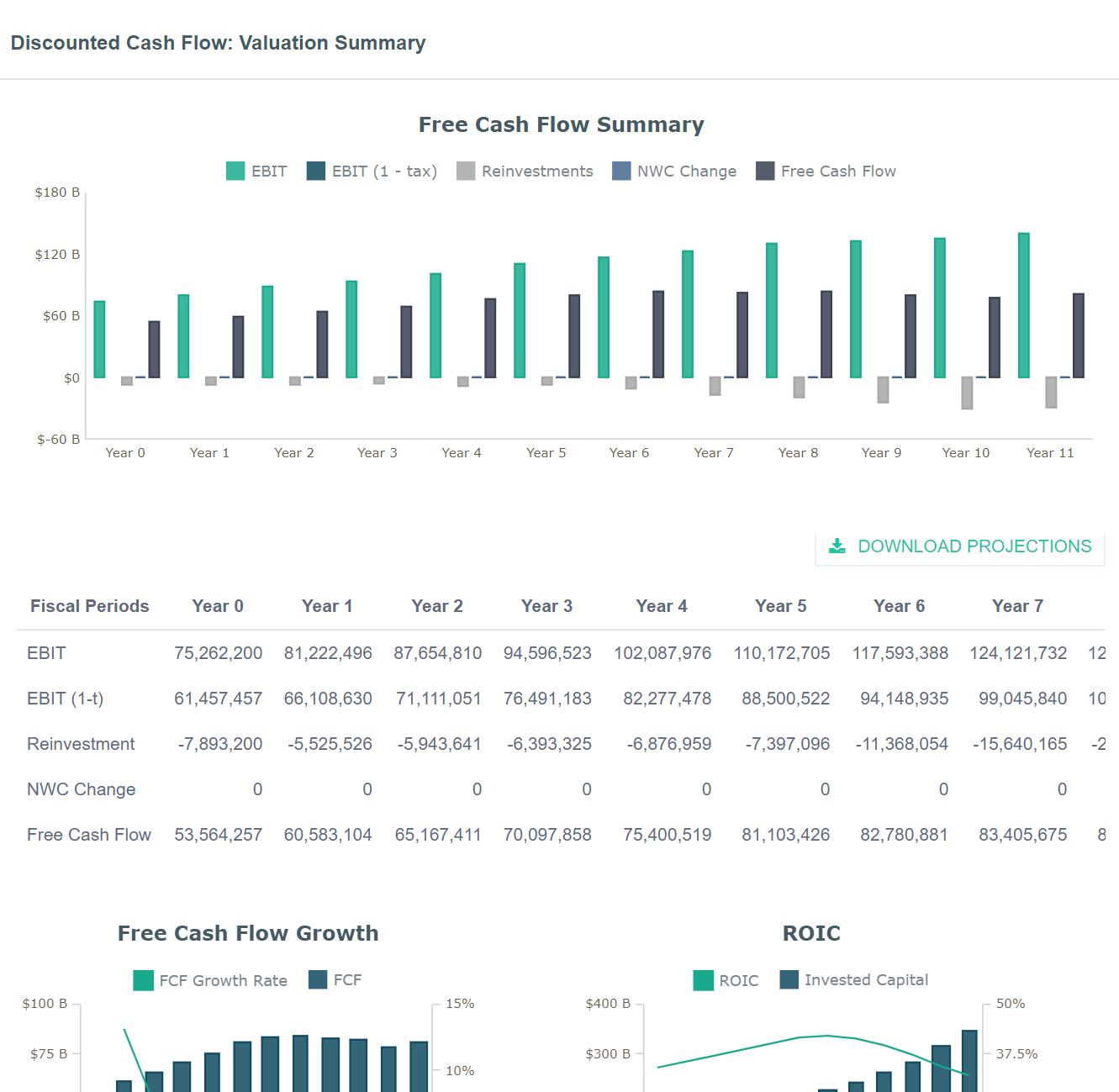

Spot trends and opportunities in model results. Transparency is part of every great valuation model. Summarized results include the data, inputs, and outputs used in the model. Charts, tables, and narratives make it easy to interpret valuation results.

Quickly change the key assumptions used in the model to stress-test and update the valuation.

DiscoverCI analyzes risk-free rates, capital ratios, interest coverage ratios, and risk-premiums to calculate the WACC used within our models.

Our model evaluates a mix of historical results and analyst projections to arrive at an expected growth rate.

What will it cost the Company to grow at the projected rate? Our algorithm calculates the cost of growth using historical and industry-specific data.

GAAP earnings only tell part of the story. We adjust for non-cash and non-operating transactions to provide a better picture of free cash flow generated by the business.

Compare model results to real-time company stock price. Reveal margin of safety between valuation based results and market pricing.

© 2021 DiscoverCI

Disclaimer: DiscoverCI LLC is not operated by a broker, a dealer, or a registered investment adviser. Under no circumstances does any information posted on DiscoverCI.com represent a recommendation to buy or sell a security. The information on this site, and in its related application software, spreadsheets, blog, email and newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. In no event shall DiscoverCI.com be liable to any member, guest or third party for any damages of any kind arising out of the use of any product, content or other material published or available on DiscoverCI.com, or relating to the use of, or inability to use, DiscoverCI.com or any content, including, without limitation, any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages. Past performance is a poor indicator of future performance. The information on this site, and in its related blog, email and newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. The information on this site is in no way guaranteed for completeness, accuracy or in any other way.