Company Intelligence to Power Better Investment Decisions

DiscoverCI automates your stock research by providing all of the tools and data you need to completely and accurately research and analyze stocks.

+Fundamental+Analysis.PNG)

DiscoverCI automates your stock research by providing all of the tools and data you need to completely and accurately research and analyze stocks.

+Fundamental+Analysis.PNG)

DiscoverCI makes it easy. Stock data, calculations, and tools all-in-one place. Quickly and easily research stocks before you invest.

Finding stocks that meet your unique investment strategy can be hard. We know, because we’ve been there too. Searching through SEC filings, updating excel spreadsheets, calculating financial ratios, and finding similar companies is no easy task. DiscoverCI’s custom stock screener, and pre-screened trade ideas brings all of these data points onto one platform.

Business Intelligence tools provide business owners with actionable insights and reporting clarity. We believe the big data and visualization tools used in BI can correlate to actionable stock market insights as well. Our charts, graphs, and comparison tools help investors identify and analyze trends in the market quickly and easily.

All of a stock’s historical operating results, financial ratios, and stock price history in one place.

DiscoverCI analyzes financial statements and calculates over 200+ financial ratios. Compare metrics to industry averages and historical results.

Chart fundamental data points to unlock hidden insights. Benchmark performance against competitors and compare stocks side-by-side.

Pre-screened stock lists that deliver awesome stocks meeting unique criteria.

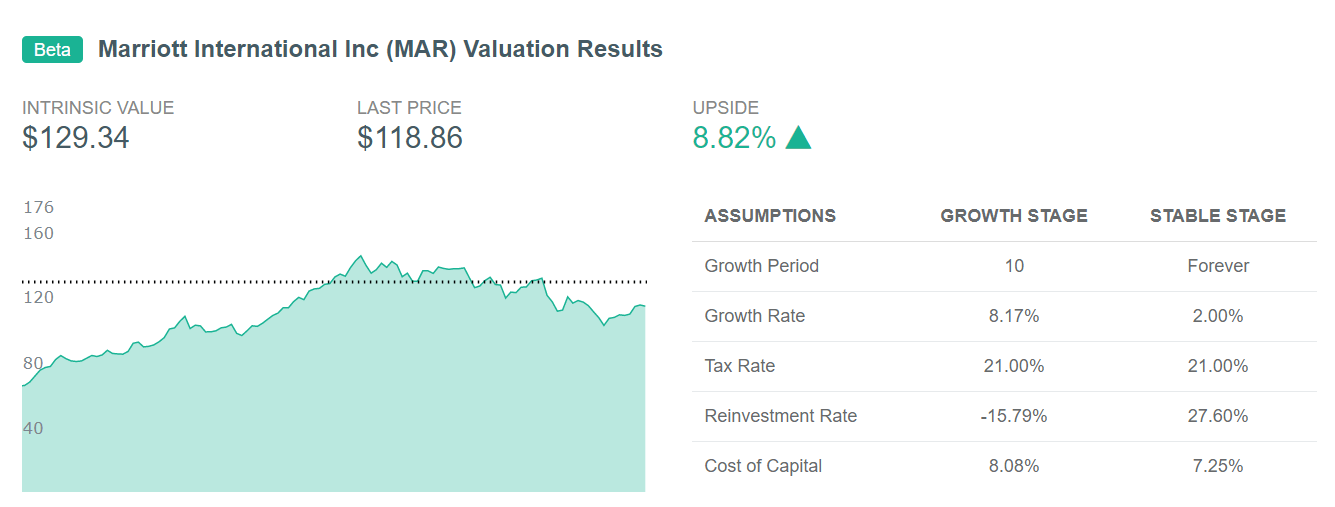

Calculate a stock’s intrinsic value to identify great stocks, at a great price. Stress test valuation inputs to find your ideal margin of safety.

Advanced stock quotes that highlight the most important deal makers and breakers.

© 2021 DiscoverCI

Disclaimer: DiscoverCI LLC is not operated by a broker, a dealer, or a registered investment adviser. Under no circumstances does any information posted on DiscoverCI.com represent a recommendation to buy or sell a security. The information on this site, and in its related application software, spreadsheets, blog, email and newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. In no event shall DiscoverCI.com be liable to any member, guest or third party for any damages of any kind arising out of the use of any product, content or other material published or available on DiscoverCI.com, or relating to the use of, or inability to use, DiscoverCI.com or any content, including, without limitation, any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages. Past performance is a poor indicator of future performance. The information on this site, and in its related blog, email and newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. The information on this site is in no way guaranteed for completeness, accuracy or in any other way.